Claim Analytics

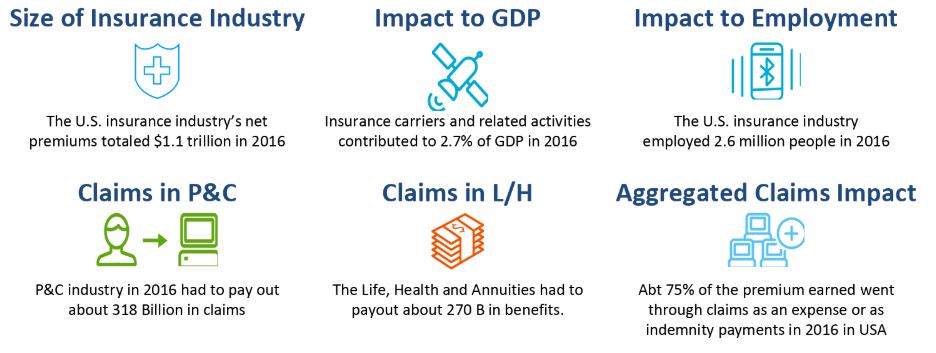

Insurance Claim is the process iniatiated by the policy holder towards the Insurance career for compensation for a covered loss or a policy event. Claims is the biggest cost to an Insurance company.

While Claim is such a significant component of the Insurance Industry and economy at large, for most part Claims Processing faces multiple challenges. It is considered to be archaic, manual, error prone, time consuming, ineffective. In many cases Claims processing lacks an effective feedback mechanism to the underwriting and pricing engines – so the changing risk profile for a policyholder goes unregistered. Often times fraud measurement for a claim is not effective enough. Also, it is further noticed that Claims are not categorized properly – hence the SIU and Adjudicators spend time on Claims irrespective of their materiality.

To mitigate these challenges Innovizant has created Claim Advisor. The product is backed by multiple Claims Analytics program experiences and industry experteze.

Claim Advisor solution has got the following salient features:

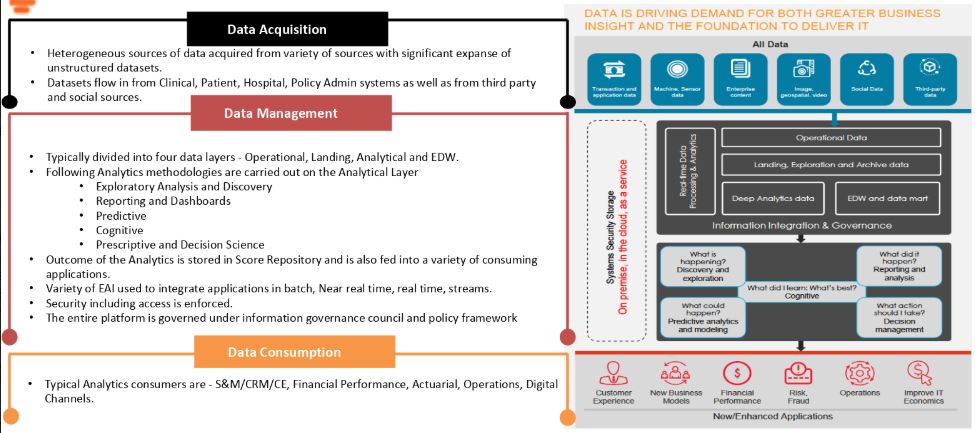

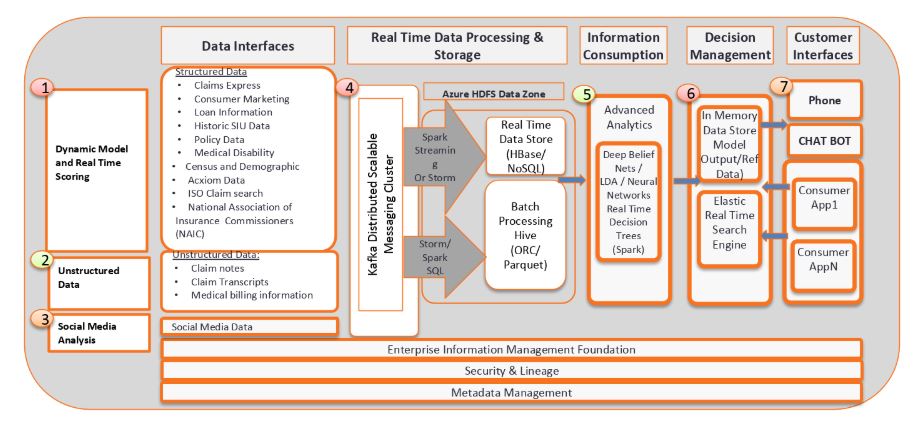

- Extensive and heterogenius adapters to onboard a variety of structred, semi-structured and unstructured data in batch, real time and stream.

- End to end real time data processing built on Spark and Webservices and is compatible to similar technology stack.

- Natural Language Processing for Claims notes and doctor’s transcripts

- Exhaustive set of Fraud models to identify Fraud Caims.

- Dynamic scoring and Claims segmentation to segregate complex riskier claims from the rest.

- Pass through processing all the way till payment for simpler claims.

- Integration with BPM systems for complex claims

- Extensive interfaces with Guideware and Duck Creek

The solution is built on Involgix’s business analytics solution platform Innosight hosted on Microsoft Azure and is also compatible for complete on-premise installations.

Why Claim Advisor is the right solution for you?

- Time tested, successfully implemented in multiple Insurance and Healthcare companies

- Robust, high performance, fault tolerant

- Exhaustive set of adapters to ingest heterogenius data in various modalities

- Exhaustive Fraud Models, Dynamic scoring, Claims Segmentation

- Seamless integration with core claims engine

- Proven methodology

- Unique Specialists in Connected Business and analytics to customize the solution.

- On-Site Innovation Center backed by Offshore Engineering Practice.

Our Expertise

- Cloud Strategy & Implementation

- DevOps and Quality Eng. Services

- Data Science & Big Data

- AI Management Consulting

- Advanced Analytics

- Custom Application Design

Target Industries

- Financial Services

- Healthcare

- Retail Services

- Insurance

- Automation

- Telecom & Media

Technology Platforms

- Cloud Computing

- Enterprise Applications & Solutions

- Salesforce Development Services