AML & Fraud Analytics

Fraud in retail banking is an umbrella term describing unlawful mechanisms with the aim of either securing unauthorized funds or goods/services without payment. It can be broadly classified into:

- Card fraud – Identity theft, phishing, mail and phone fraud, and online fraud

- Deposit fraud – Fraud against bank deposits, check fraud, online banking fraud, mobile banking fraud, and wire fraud

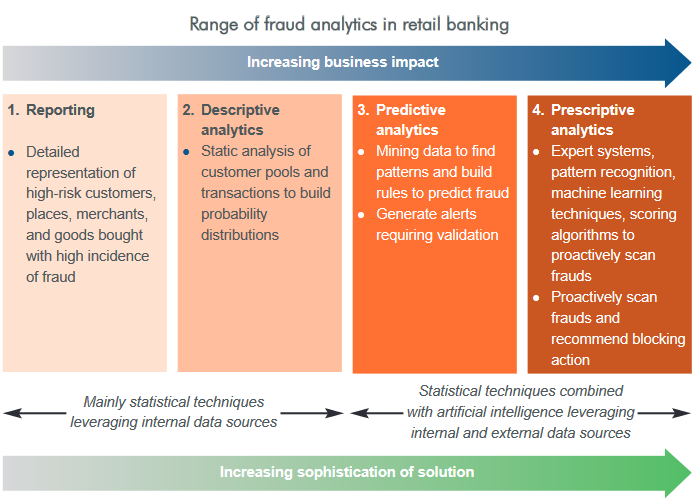

Most of these frauds are low-value and high-volume in nature. So they presentan excellent opportunity for analytics to identify patterns and recommend preventive action. Many of the techniques employed to detect frauds require recognizing identical/repeating pattern matches of people, places, systems, and events. There are various methodologies employed for fraud detection, enabling a wide range of solutions (see Figure below). Beyond statistical techniques, artificial intelligence is also starting to be leveraged to prevent fraud.

Effective use of analytics to fight fraud can help improve profitability in the cards business (this has acquired even greater significance after the passage of Durbin Amendment), reduce payouts and legal hassles, and most importantly, improve customer satisfaction. Time taken to act, once fraud is detected, is also critical and often a last step human intervention is required to act on fraud alerts. Analytics help improves the ability of existing fraud experts to focus on real threats more efficiently and effectively (by expanding transactions monitored and reducing false alerts). Automated alerts can also be sent to the customer directly. However, the biggest value that analytics brings to the table is to go beyond detection – by predicting and even preventing fraud.

Advanced analytics help in recognizing patterns of fraudulent transactions, and then use these to be one-step ahead of fraudsters, predict the next such fraud in progress, and recommend taking preventive action, saving both the bank and the customer.

Initiatives to develop predictive and prescriptive analytics based on pattern recognitions, typically hit the following major operational challenges:

1. Balancing Priorities

The triad of competitive offering, customer demands, and security pull in different directions – competitive forces strain banks’ abilities to do more of fraud prevention, customers want cards to be accepted widely, security demands restricted, and careful usage. Banks have to walk the tightrope between the three forces to succeed

2. Resource Constraints

Multiple algorithms and engines’ results need to be integrated and interpreted for predicting fraudulent activities, presenting a significant computing challenge. The filtering out of false alarms generated by algorithm(s) adds to the complexity in the process

3. Stay ahead of Fraudsters

Fraud analytics models need constant adjustment and enhancement. Once a fraud technique is identified, the model quickly needs to assimilate that information, and start looking for the next loophole, that a potential fraudster may exploit. Since the entire game hinges on being able to prevent commitment of fraud, the pressure is always on the bank to be a head of fraudsters.

Our Expertise

- Cloud Strategy & Implementation

- DevOps and Quality Eng. Services

- Data Science & Big Data

- AI Management Consulting

- Advanced Analytics

- Custom Application Design

Target Industries

- Financial Services

- Healthcare

- Retail Services

- Insurance

- Automation

- Telecom & Media

Technology Platforms

- Cloud Computing

- Enterprise Applications & Solutions

- Salesforce Development Services